LeoStella’s plight shows how the U.S. is a hard market for European satellite manufacturers

When announced in 2019, LeoStella looked poised for success. The 50/50 joint venture of Thales Alenia Space and Spaceflight had built a factory sized for up to 30 satellites per annum. It had an anchor customer in BlackSky, and the precedent of rival Airbus establishing a big U.S. presence through a joint venture with OneWeb three years prior. Both Thales Alenia Space and Airbus Defence and Space thought JVs with U.S. companies would cement their presence across the Atlantic, but have found long-term success difficult.

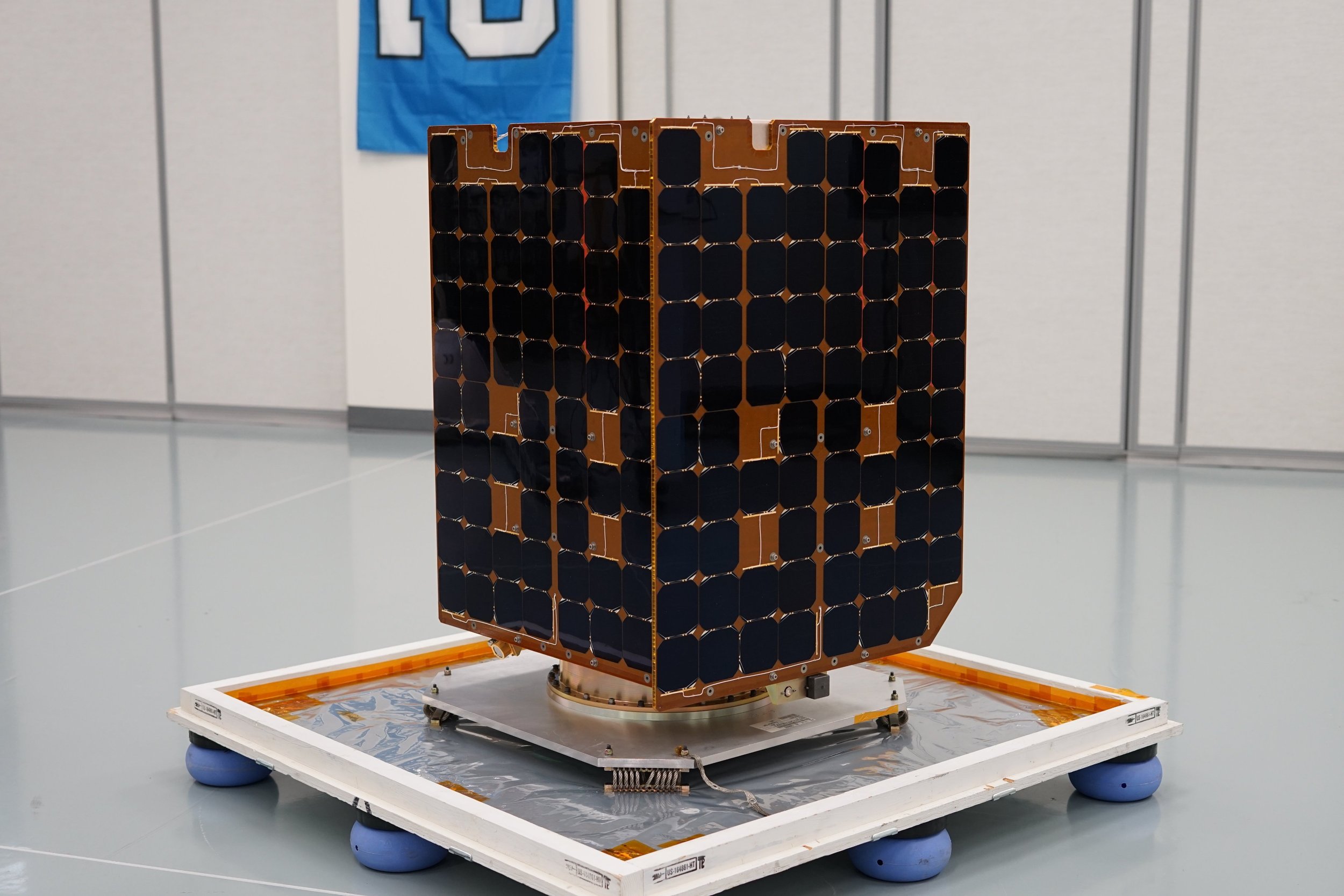

LeoStella on June 5 announced it has built just 20 satellites in its four years of operations, and despite an increased factory capacity capable of 40 satellites per year, is projecting just seven builds in 2023. We identify three primary reasons for this difficulty.

• Closed customers. Vertical integration continues to take a heavy toll on companies that built businesses on the hope of more outsourcing. The argument was that early companies like Planet and Spire needed to build their satellites in house because there were no options. Today the U.S. is home to more than a dozen smallsat manufacturers, yet around 40% of leading constellation startups continue to choose vertical integration. The commercial market simply has not yielded the level of demand many expected.

• Disinterested government. LeoStella, as a U.S./European joint venture, has been virtually absent from the U.S. government market despite years of effort. It’s no secret that U.S. government agencies are often unwilling, if not mandated against, buying satellites from foreign companies, even from allied nations. Joint ventures appeared to be a promising workaround, but little fruit has come from these either. In its five-year history, LeoStella has mainly built satellites for BlackSky and Loft Orbital. The company can publicly claim one arm’s-length government customer in that it supplied a bus for a DARPA mission called “Sagittarius A*,” that was orchestrated by Loft Orbital.

• Partner pullback. Earth observation company BlackSky, which serves as LeoStella’s anchor customer and 50% shareholder, reduced its plans from 60 satellites in 2015 to just 14 in 2023 – less than a quarter of their early vision. BlackSky has no near-term plans to increase constellation size, meaning the best LeoStella can expect is a trickle of Gen-3 upgrades/replenishment orders.

Despite this bleak backdrop, there is potential for change, mainly through the Space Development Agency (SDA), which has demonstrated a willingness to choose nontraditional vendors. Rival joint venture Airbus OneWeb Satellites took seven years before landing a major defense contract – a bus order from Northrop Grumman for 42 SDA satellites. SDA plans to order hundreds more satellites in the coming years. If LeoStella can clinch a deal, its factory could go from empty to full overnight.

SOURCE: https://www.businesswire.com/news/home/20230605005195/en/LeoStella-Manufactures-and-Delivers-its-Twentieth-Satellite/?feedref=JjAwJuNHiystnCoBq_hl-bV7DTIYheT0D-1vT4_bKFzt_EW40VMdK6eG-WLfRGUE1fJraLPL1g6AeUGJlCTYs7Oafol48Kkc8KJgZoTHgMu0w8LYSbRdYOj2VdwnuKwa